Deliberately Keeping Your Income Under $75k to Avoid Having to Deal with GST? You Might Want to Rethink That

Avoiding Registering for GST Can Hurt Your Business

It’s a common practice for sole traders: keeping your income under $75,000 so you don’t have to register for GST.

“Better not earn too much or I’ll have to register for GST!” Sound familiar?

If you’ve ever slowed down your bookings, kept prices low, or avoided marketing just to stay under the threshold, you’re not alone. But here’s the kicker: that strategy might be costing you more than you think—and not just financially.

To many Aussie sole traders, it makes sense. You avoid another tiresome registration process. You don’t have to modify your invoicing and accounting systems to add GST to your invoices, or separate GST out of purchases and expenses. You don’t have to lodge that quarterly – or worse, monthly — BAS. You don’t have to spread yourself even thinner to allocate precious time and energy to these things.

But is it actually a good strategy for your business long-term?

Let’s take a look — from both a numbers and mindset perspective.

If You Think It’s Not Worth the Effort, You’d Be Right – at $75k

Let’s say your annual revenue (i.e. income before expenses) is $75,000, and pretend GST registration is voluntary.

A. Annual Revenue $75,000, Not Registered for GST

Assuming 20% of that revenue goes to business expenses, here’s how the numbers stack up:

Income: $75,000

Expenses: $15,000 ($75,000 Revenue x 20%)

Side note: When you’re not registered for GST, the expense amount you claim on your income tax return includes the GST. But you don’t get the full GST amount back — it just reduces your taxable income and therefore the amount of income tax you have to pay.

Profit before tax: $60,000 ($75,000 Revenue - $15,000 Expenses)

Income tax + Medicare Levy (approx): $ 9,988 (see the MoneySmart income tax calculator here for more detail)

After-tax profit: $50,012

Apart from the conniption you might have just had at the realisation that the grubby-ment is making out like a bandit with ten grand of your money —

(I hope you’re setting that money aside throughout the year in preparation for that income tax bill – too many sole traders aren’t!)

— it’s pretty straightforward. Maybe the ATO puts you on its PAYG system and you prepay what it estimates will be next year’s bill in quarterly instalments. Nothing too complicated there.

B. Annual Revenue $75,000, Registered for GST

Assuming business expenses are, like before, 20% of business revenue, and, like before, include GST, here’s what happens this time:

BAS Return:

GST collected: $7,500.00 ($75,000 Revenue x 10%)

GST paid (claimable): $1,363.64 ($15,000 Expenses divided by 1.1 — unless your receipts include GST-free or non-GST items).

Note: If you suck at maths and thought it should be divided by 10 here, no. When a price includes GST, that means:

10 parts = the original price

1 part = the GST

Total = 11 parts

So we divide by 11 to get that one part, the GST.

- Net GST payable to ATO: $6,136.36

Income Tax Return:

- Profit before tax: $61,364 ($75,000 Revenue – Expenses without GST, i.e. ($15,000 Expenses - $1,363.64 already claimed on BAS))

- Income tax + Medicare Levy (approx): $10,424 (see the MoneySmart income tax calculator here for more detail)

- After-tax profit: $ 50,940

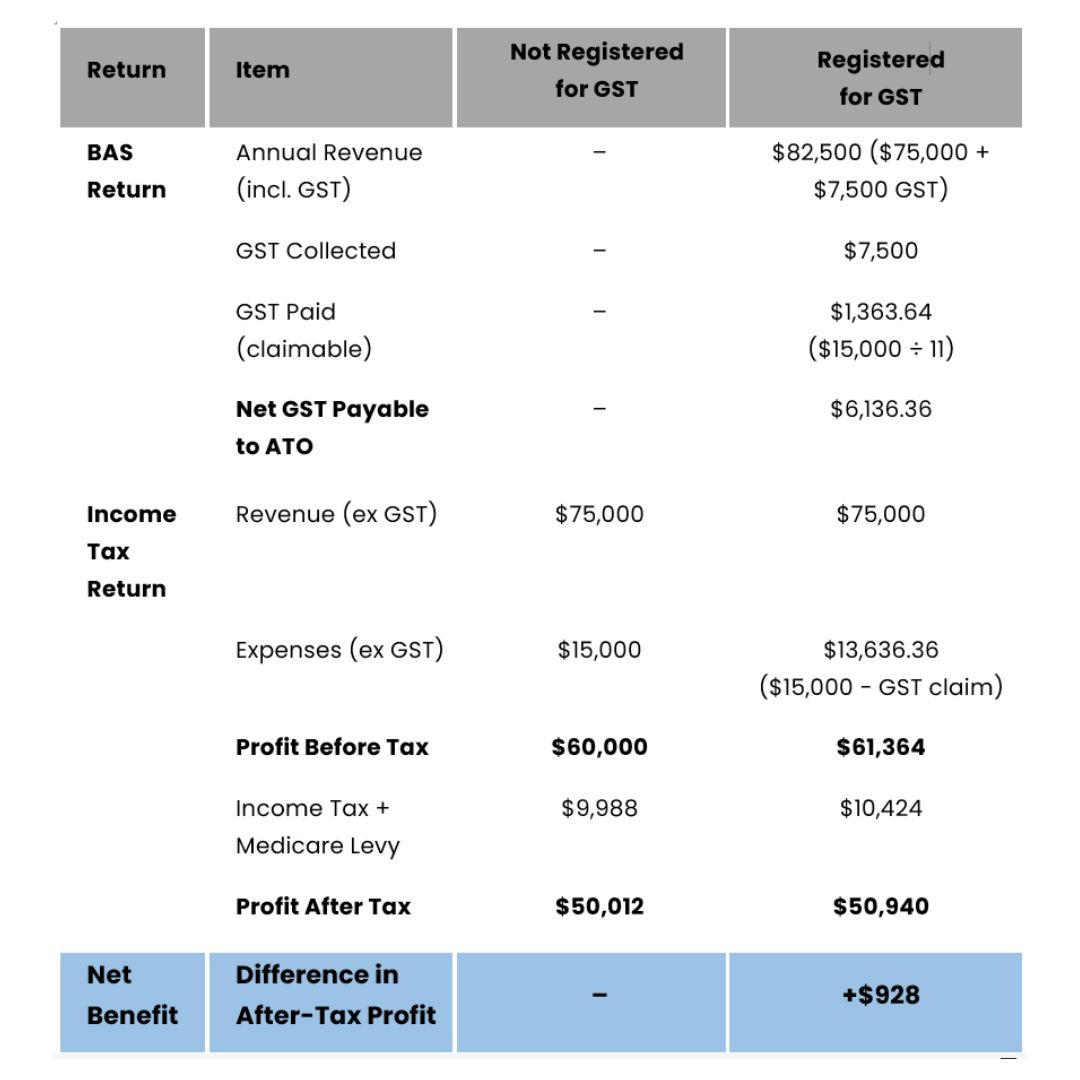

Here it is side by side if that makes it easier to process:

💼 Comparison: GST Registered vs Not Registered (at $75k Revenue)

So you’re $928 better off by registering for GST. The reason for that is, you can claim the full GST amount on business expenses, rather than just your income tax rate percentage of it.

If you’re thinking, I’m not going through all that rigmarole just for a lousy $928 … I don’t blame you!

What if you were to earn more?

What if you were to let your income go higher, and just surrender to the whole GST thing?

Here’s what happens if your revenue is $100,000 and you collect — not earn, because it’s not your income, you’re just collecting a tax on behalf of the grubby-ment (congratulations on your new unpaid job as a tax collector 😊😔) — another $10,000 on top of that by adding 10% GST to your client invoices:

You earn $100,000 + collect $10,000 GST

So your clients pay you $110,000 total

You spend $20,000 total on business stuff (which, again, includes GST)

What Happens:

👉 GST (handled in your BAS):

- You collected $10,000 GST from your clients on behalf of the ATO

- You paid $1,818.18 GST to suppliers (the GST included in your $20,000 expenses, or $20,000 / 11)

- You give the ATO the difference: $8,182.82 ($10,000 GST Collected - $1,818.18 GST Paid)

👉 Income Tax (handled in your tax return):

- Income: $100,000

- Expenses: $18,181.82 ($20,000 Expenses - $1,818.18 GST already claimed on your BAS)

- Profit before tax: $81,818

- Income tax + Medicare Levy (approx): $16,970 (see the MoneySmart income tax calculator here for more detail)

- After-tax profit: $64,848

Which is a $ 14,836 reward ($64,848 after-tax profit less $50,012 after tax profit) — per year — for getting over your fear of the whole GST thing.

Here’s the $75k “Avoid the GST Thing at all costs” vs the $100k “GST-Schmee-ST, I’d rather make more money” scenarios side by side if that makes it easier to process:

💼 Comparison: Not Registered vs Registered for GST (with $100k Revenue + GST)

Honey, that’s enough to pay a registered BAS agent to do your books every month (assuming your bookkeeping is reasonably straightforward and they don’t have to wade through a decade’s worth of ‘shoebox accounting’) and prepare your BAS every quarter, and go on a damn good holiday each year.

(If you need to know more about what bookkeepers charge, here’s a good article about it.)

And if you have a simple sole trader business, GST and BAS really aren’t that hard once you get the hang of it and set up your systems for it — so you might even be able to do it all yourself and have an even better holiday.

$50k after tax profit isn’t the same as a $50k take home pay from a job

Okay so you’re taking home $50k after tax. But that’s not the same as a $50k take home pay from a job.

A $50k employee salary comes with:

- Paid holidays

- Sick leave

- Super

- Worker’s comp

- Maybe even bonuses, training, or overtime

But $50k as a sole trader? That’s all on you. No holidays. No super. No safety net. Just your two hands, your body, and the hope you don’t get injured or burnt out.

The GST Threshold Hasn’t Changed Since 2007

The final thing I want to say with my accountant’s hat on is, the GST threshold of $75k hasn’t changed since 2007, when it was raised to that from the initial threshold of $50k. It’s not indexed to inflation – if it was, it’d be around $120,000 by now.

So with the inflationary effects of money, deliberately keeping your income under the GST threshold year after year means you’re effectively giving yourself a pay cut every year.

Dude. Your boss sucks.

I’ve written another article about the effect of inflation on your income here.

The Money Coach’s Two Cents: How Staying Under $75k Hurts You

Ok that’s the accountant’s argument for getting over your aversion to the whole GST Thing — now let me put on my money coach hat and give you some more things to consider if you’re deliberately keeping your income under $75k just to avoid the GST system.

💸 1. You’re capping your income — on purpose

- You start making real money, and instead of riding that wave, you pump the brakes. Why? Because you’re afraid of the paperwork.

- That’s self-sabotage disguised as “smart business.”

🤏 2. You’re not just avoiding admin — you’re avoiding growth

- Staying under the threshold usually means:

o Not marketing harder

o Not raising prices

o Not booking out

- You shrink your own business so you don’t have to deal with GST. That’s not business strategy — that’s fear management.

⏳ 3. You’re wasting time managing your limits instead of your potential

- Every time you eye your calendar or Stripe account thinking, “Better slow down or I’ll go over,” you’re wasting brainpower that could be spent building better systems, services, or pricing.

🔐 4. You’re locking yourself out of legit opportunities

- Want to subcontract? Land business-to-business clients? Apply for grants? Work with bigger organisations? They’ll want you GST registered.

- Playing small isn’t just about the money — it limits your career options.

🛑 5. It builds a subconscious glass ceiling

- The longer you stay under, the scarier it seems to go over.

- The resistance builds. You start believing that $75k is your limit.

Here’s a question for you:

Would you still be keeping your income under $75k if you weren’t dodging GST?

Probably not.

And if the answer is no — if your business would naturally grow past that threshold — then dodging GST isn’t protecting your business, it’s stunting it.

The Fear of Losing Clients by Charging More

Now, if you’re thinking,

“But I can’t raise my prices — I’ll lose clients!”

You might be right. But here’s the thing:

If your clients drop off the second you raise prices, they were probably never in it for the long haul anyway. And chances are, you're undercharging for your skill, your presence, and the healing work you do.

There are clients out there who will happily pay more — and they're often the ones who respect your boundaries, pay on time, and would never expect you to work for free.

So, ask yourself honestly:

Are you really protecting your business by avoiding GST — or are you just holding it back?

Don’t Let the Tax Man Stand Between You and Your Potential

If you’ve been treating $75k like a glass ceiling because of GST, it might be time to get your rage on and smash that sucker.

You can absolutely learn how to handle GST — or make enough money to outsource it to a pro.

Either way, don’t let fear of paperwork keep you from growing into the business (and income) you’re capable of.

Disclaimer: This content is for general educational purposes only and does not constitute tax advice. Please speak to a registered BAS or tax agent about your specific tax circumstances.

About the Author

Anna Mitchell is a degree-qualified accountant — who was also a massage therapist for a few years, working for corporate wellness agencies on an ABN — and avoiding her accounting like massage clients avoid doing the stretches you recommended.

All that sticking her head in the sand got her was nine years behind on her tax returns. Nine. Years. If an accountant can mess up her accounting that bad, maybe you’re not such a loser after all.

After untangling that mess in 2019, she built herself a system to make sure it never happened again. That turned into That Accounting Stuff — online courses for Aussie sole traders who’d rather eat a book than do their books.

Now she helps people like you go from Accounting Zero to Accounting Hero — so you can ditch the tax-time panic, stop those nasty cashflow-destroying surprises, and finally feel like a ‘proper’ business owner who knows their key numbers (and is way more likely to succeed).